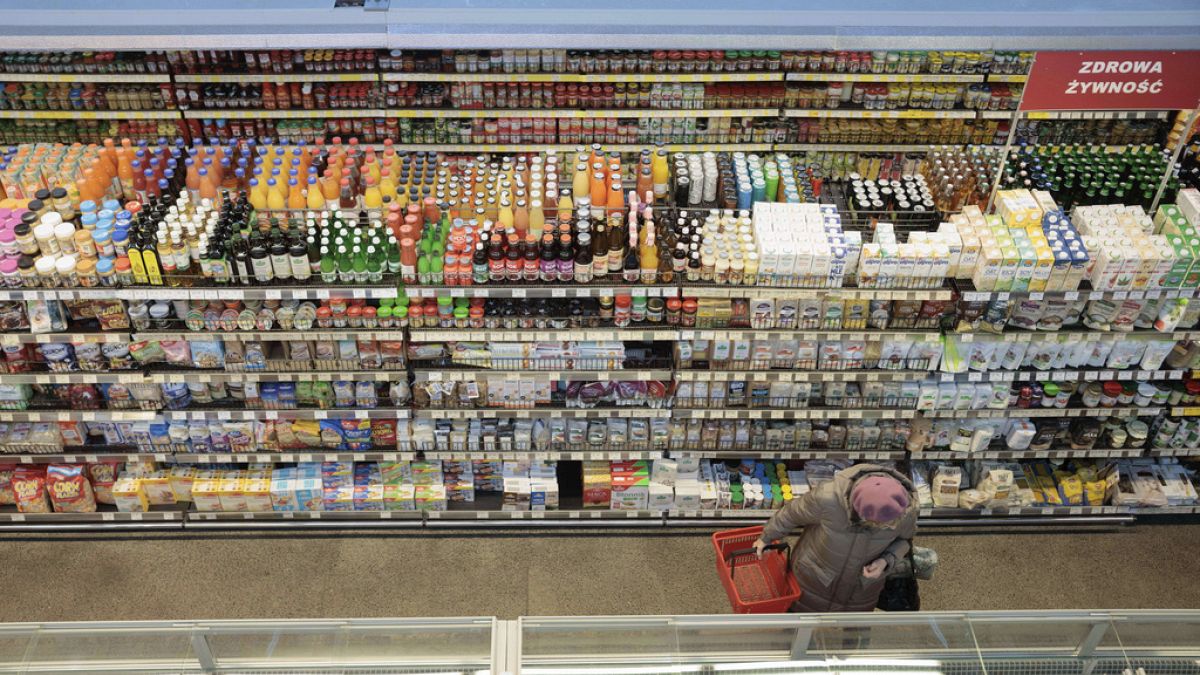

Despite a fall in inflation, Poland's central bank governor remains concerned it could reignite because of higher food taxes and the potential removal of energy price limits.

Today, Poland's central bank confirmed its decision to maintain interest rates at 5.75%, despite recent indications of economic weakness for a seventh consecutive meeting.

Central Bank Governor Adam Glapinski said last month that he would not cut borrowing costs, citing concerns about a potential rise in inflation because of higher food taxes and the potential removal of energy price limits.

Poland's annual inflation rate fell in March, dropping to 1.9% from the previous month's 2.8% and beating market expectations of 2.2%.

However, the Monetary Policy Council (MPC) highlighted "substantial uncertainty" regarding inflation fluctuations, primarily influenced by fiscal and regulatory policies, as well as the pace of economic recovery and labour market conditions in Poland.

In contrast to Glapinski, Finance Minister Andrzej Domanski suggested last month that lower rates could benefit the economy. However, within the 10-member MPC, only a minority supports reintroducing rate cuts, pending confirmation that the government's energy pricing plans won't trigger inflation.

Investors will closely watch for any change in the outlook for interest rates during Glapinski's monthly news conference, scheduled for 3 p.m. in Warsaw on Friday, as reported by Bloomberg.

Since implementing significant rate cuts ahead of a general election last October, the governor has taken a more cautious approach, regularly citing inflation risks as a hindrance to further rate reductions