China reported weaker-than-expected gross domestic production (GDP) data for the second quarter and softened economic data for June. The country also began its Third Plenum key political meeting.

China released a raft of disappointing economic data, causing its stock markets to fall on Monday. The benchmark Hang Seng Index dropped more than 1% in the first hour of trading, following a sharp rebound last week. Investors are worried about China's economic prospects amidst sluggish domestic demand, a property crisis, and escalating geopolitical tensions.

Additionally, the country has launched its political meeting, the Third Plenum, which is expected to introduce policy reforms aimed at tackling growth challenges in the world's second-largest economy. Key policies may encompass government finance, tax reform, technological advancement, and foreign investment

China encounters faltering economic recovery

According to China's National Bureau of Statistics, its GDP grew by 4.7% in the second quarter at an annualised pace, much weaker than the estimated 5.1%, and down from 5.3% in the first quarter. This raises doubts about whether the country can achieve its growth target of 5% set for 2024, making the Communist Party's Third Plenum meeting, running from Monday to Thursday, a critical event for global markets.

Additionally, the long-troubled property market continued to face pressure, with new home prices falling by 4.5% from a year ago in June, marking the lowest level since June 2015. This decline was steeper than the 3.9% decrease observed in the previous month and represents the sharpest fall in nine years.

Furthermore, China's retail sales rose by 2% year-on-year in June, falling short of the expected 3.3% increase, and down from 3.7% in May. On a positive note, industrial production increased by 5.3% compared with a year earlier in June, surpassing the expected 5.1%, but decelerating from 5.6% in May. Fixed asset investment in China rose by 3.9% in the first half of the year, slightly down from 4% in the previous month.

China has been experiencing a slowdown in economic growth since 2021 when the country implemented stringent Covid-19 restrictions. The post-pandemic recovery has been viewed as faltering, with weak consumer demand contributing to deflationary pressures between August 2023 and the beginning of this year, alongside escalating US-China tensions and the ongoing property crisis.

However, the Chinese government faces a dilemma in addressing these growth challenges, balancing the risks of over-stimulating the economy. The People's Bank of China (PBOC) allowed some of its medium-term lending facility (MLF) – a financial tool for managing liquidity and guiding interest rates in the financial system – to roll over, withdrawing 3 billion yuan of cash for the fifth consecutive month. As expected, the PBOC kept the loan rate on the 1-year MLF unchanged at 2.5%. The central bank's cautious approach suggests that China aims to support the economy with limited stimulus measures while avoiding the creation of bubbles and further devaluation of the Chinese Yuan.

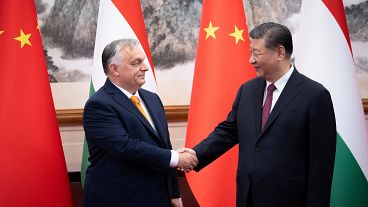

Chinese policymakers gather for the Third Plenum meeting

Following the GDP release, China is set to commence the Third Plenum meeting, which is viewed as a pivotal political event shaping the country's economic landscape. The Third Plenum of the Central Committee of the Communist Party of China (CPC) occurs during its five-year tenure and serves as a crucial event where significant policy directions and reforms are deliberated and decided upon. Historically, the Third Plenum has been a turning point for China's economic and political strategies. For instance, the 1978 Third Plenum marked the inception of China's "Reform and Opening-up" policy under Deng Xiaoping's leadership, catalysing the country's economic transformation. Similarly, the 2013 meeting introduced a wide-ranging reform agenda covering the economy, governance, social policies, and the legal system.

During this upcoming meeting, China is expected to continue advancing economic reforms, shifting focus from reliance on land sales towards technological advancements. Economists anticipate that China will unveil measures to address the downturn in the real estate sector, fiscal relations between central and local governments, and priorities in technology development. Potential reforms could include the introduction of a consumption tax to bolster government revenue and adjustments to retirement age policies to tackle a rapidly aging population. Additionally, measures to enhance foreign investment opportunities to stimulate capital inflows may also be discussed.