Alphabet is set to report its second-quarter earnings later today, with artificial intelligence (AI), cloud, and advertising revenue remaining key focuses. Wiz walked away from a $23 billion deal with Google hours before the earnings release.

Google's parent company, Alphabet, is set to report earnings after the US markets close today, providing insight into the health of its AI-led business. Alphabet posted impressive first-quarter earnings due to growth acceleration in its Google Cloud and advertising sales. Investors expect the company to unveil further innovations in its AI initiatives, an area in which Alphabet has heavily invested. Alphabet shares have risen 31% year-to-date, surpassing the Nasdaq Composite's 20% growth.

Past performance and forecast

In the first quarter, The overall revenue increased 15% from a year ago to $80.54 billion (€73.96 billion), with earnings per share of $1.89 (€1.74). Alphabet also approved its first-ever dividend and announced a $70 billion (€64 billion) share buyback programme. Alphabet demonstrated robust growth in both advertising sales and its Google Cloud business, up 13% and 28% year on year, to $61.66 billion (€56.62 billion) and $8.09 billion (€7.43 billion), respectively. Additionally, YouTube advertising showed continuous strength, contributing revenue of $8.09 billion.

Analysts expect the tech giant to report earnings of $84.3 billion, representing a 13% growth from last year. The net income is expected to be $23 billion, with earnings per share of $1.85, reflecting a 28% annual increase, according to Visible Alpha.

Alphabet has a history of beating earnings estimates in the past consecutive quarters, with earnings growth accelerating since 2023. Investors have high expectations for its second-quarter performance as the AI-supported development in Google Cloud may illustrate significant technological advancement.

Key growing area

The AI-powered Google Cloud and advertising revenue, particularly from YouTube, remain key metrics of Alphabet's performance. Google invested $12 billion in AI infrastructure, primarily focused on data centres, during the first quarter. Investors would like to see this segment bring more growth prospects, as CEO Sundar Pichai expressed confidence in effectively managing the transition to monetisation following these substantial investments. In the first quarter, Alphabet nearly doubled its capital expenditures to $12 billion from a year earlier. The tech pioneer has set an ambitious target to achieve a combined Google Cloud and YouTube annual run rate of more than $100 billion by the end of 2024, an 85% surge from 2023.

The operating income of Google Cloud increased to $900 million from $191 million a year earlier in the first quarter, evidencing that the massive investment has finally borne fruit. Google Cloud holds the third position in market share, trailing behind Amazon's AWS and Microsoft's Azure. Chief Financial Officer Ruth Porat expressed enthusiasm, stating: "The main thing is, we are excited about the benefit from AI for our cloud customers."

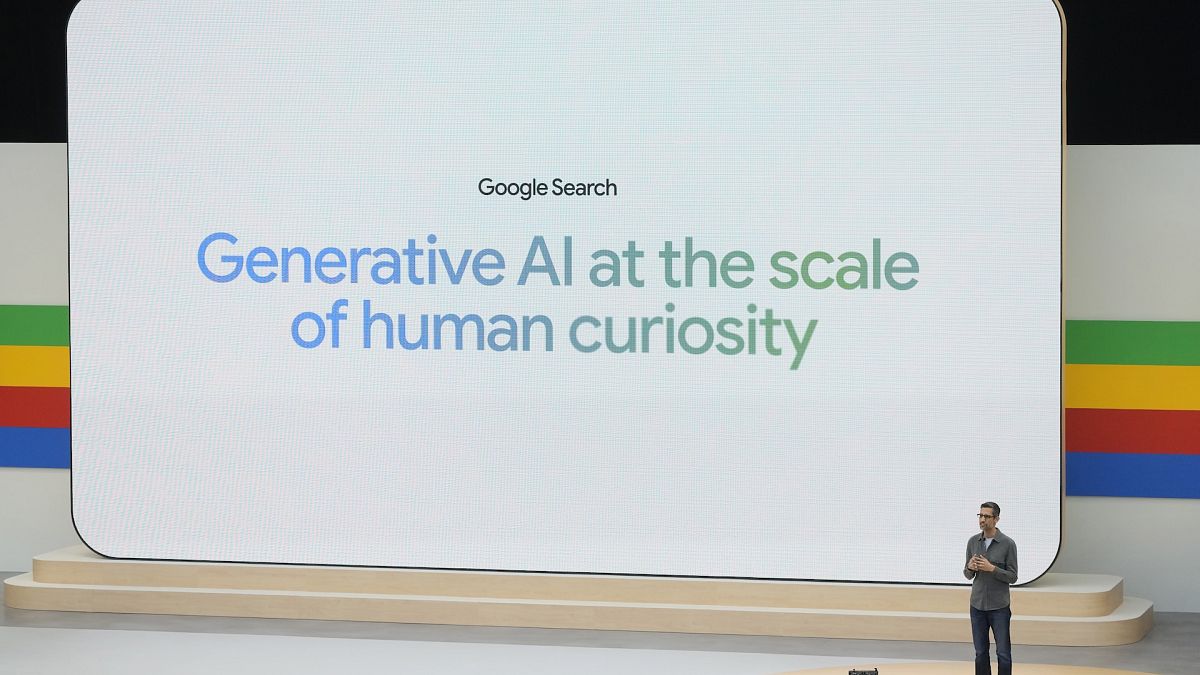

At Google I/O, an annual developer conference, Google emphasised its chatbot tool as "Gemini Era", and unveiled an AI assistant called "Project Astra" that can be integrated into Gemini, enabling sound input and identifying vision via a smartphone camera. The initiative is seen as critical to competing with Microsoft's ChatGPT and Copilot.

Wiz walks away from $23 billion deal with Google

Cybersecurity firm Wiz called off a $23 billion (€21 billion) deal for being acquired by Alphabet on Tuesday, hours before the Google parent company reports its quarterly earnings. Wiz said it would pursue an initial public offering. Alphabet was reportedly in talks with Wiz earlier this month for the potential biggest deal ever. This could be a setback for Alphabet due to its heavy bets in building the AI infrastructure. The news also followed the largest-ever IT outage from cybersecurity giant CrowdStrike, causing broad disruption in TVs, air travel, and Microsoft's cloud services on last Friday.