These restrictions are speculated to be China’s response to the US export curbs on the sale of advanced semiconductor chips to Chinese companies such as Huawei.

China’s ongoing export restrictions on key semiconductor metals have led to backlogged supply chains and increased worries about the possibility of Western manufacturers and consumers facing chip shortages.

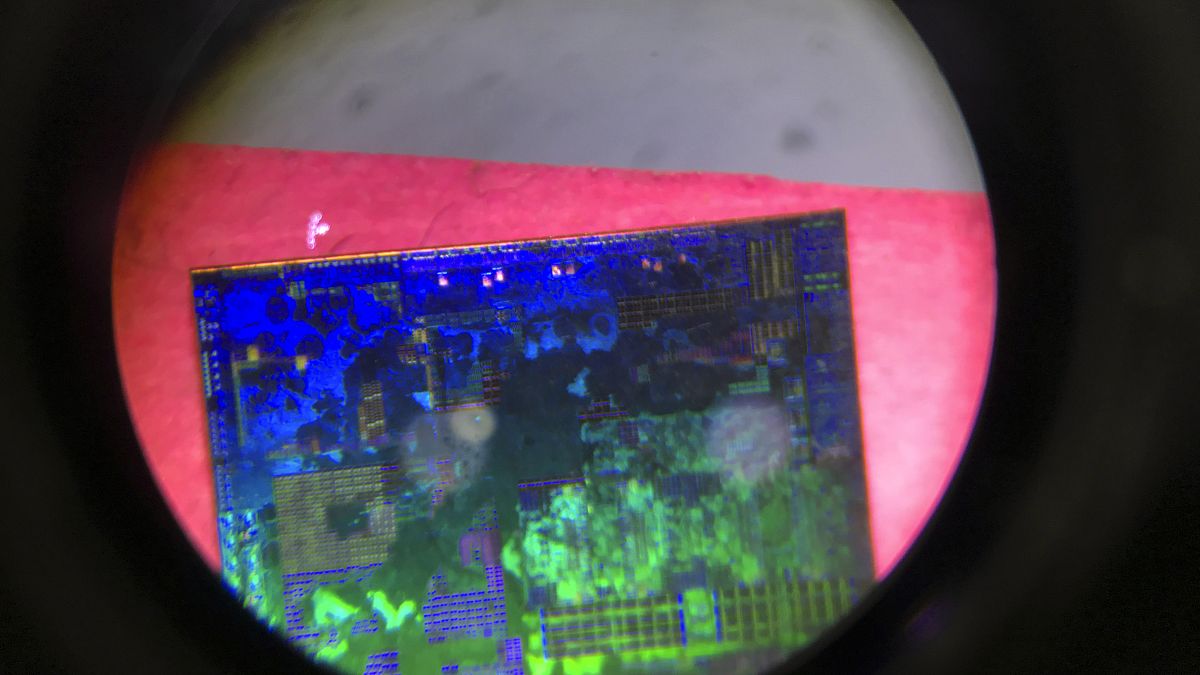

These semiconductor metals, namely gallium and germanium, are used extensively in chips, communications and military equipment.

China was the top producer of gallium globally in 2022, accounting for more than 98% of worldwide production, according to Statista, with Russia a distant second, contributing only 0.81% of global production. According to the Critical Raw Materials Alliance, China also currently accounts for 60% of global germanium production.

The country announced these export curbs last July, enforcing them from August 2023. As both these metals are exceptionally rare, these restrictions have meant that both gallium and germanium prices have surged, especially in Europe.

Chinese exports of germanium dropped from 13,514kg in the second half of last year, to 12,410kg in the first half of 2024, according to the Financial Times, using Chinese customs data. Similarly, following the introduction of the export curbs, Chinese gallium exports also plunged from 28,000kg in the first half of 2023, to 16,000kg in the second half of 2023.

China has revealed that it has imposed these curbs to protect its national interests and security. However, it is largely speculated that these are Beijing’s answer to the US export controls on the sale of highly advanced semiconductor chips and production equipment to Chinese companies such as Huawei.

The US earlier revealed that it was imposing these export curbs in order to limit China’s access to semiconductors for military and artificial intelligence uses. In turn, China has also restricted exports of graphite, as well as antimony, which is a mineral used in armour-piercing ammunition.

Gallium is also used for bulbs, transistors, medical processes and thermometers, whereas germanium is used for infrared optical instruments and plastic production. They are also critical for things like night vision goggles and fibre-optic cables, which may also see shortages and price hikes as a result of export restrictions.

Europe could take several years to scale up its gallium and germanium production

Following China announcing these controls last year, the US International Trade Commission said: “The global supply chain for germanium and gallium is expected to encounter significant changes with the Chinese government’s announcement of new export controls on these critical minerals, effective 1 August 2023. Germanium and gallium hold immense importance in various industries such as semiconductors, solar panels and electric vehicles.

“The United States is heavily reliant on imports for both of these critical minerals, especially from China, given its dominant role as a major producer and supplier of both products.”

Although several European companies still have some stockpiles of galium to tide them over in the short term, the long-term scenario is more uncertain, as Europe may not be able to scale up its own domestic production of the metals quickly enough.

SEMI Europe, a microelectronics industry association said: “In the long term, in the event of trade escalations and further export restrictions, the European semiconductor industry could be impacted by a shortage of critical raw materials, particularly considering the lack of domestic production capacity for the foreseeable future.

“Building up a respective value chain from mining to processing with sufficient capacity in Europe would require significant time and large investments, to allow supply chains and market prices to adjust effectively. The establishment of suitable production facilities in Europe could take multiple years to scale up.”