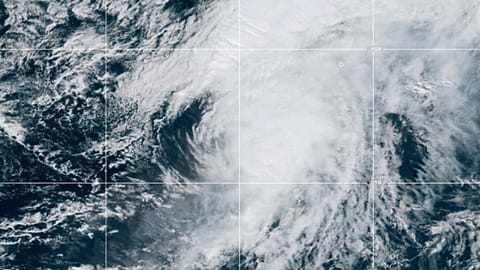

In July, the country was pummelled by winds of up to 240 kilometres an hour which razed whole neighbourhoods and downed power lines.

ADVERTISEMENT

ADVERTISEMENT

In a world first, Grenada has postponed debt repayments in the wake of a natural disaster.

Hurricane Beryl swept through the Caribbean in early July, battering towns and coastlines.

The island nation of Grenada was pummelled by winds of up to 240 kilometres an hour which razed whole neighbourhoods and downed power lines.

Last week, officials chose to enact debt suspension clauses in government bonds, which could help make the measure the norm for climate-vulnerable countries.

Pause debt repayments after hurricane Beryl will save Grenada €27 million

Hurricane Beryl left a trail of destruction amounting to a third of the country’s annual economic output, according to initial government estimates.

Two decades ago, hurricane Ivan brought similar economic grief and sparked a spiral of financial struggles that resulted in a debt default.

This time round, authorities are hoping to avoid similar disastrous consequences by using hurricane clauses that form part of government agreements with international creditors.

By activating this provision, debt repayments to private investors including US investment firms Franklin Templeton and T. Rowe Price have been postponed.

The measure will allow the island nation to save around $30 million (€27 million) in repayments due this November and next May.

The debt will be carried over to future bills, but the interim financial saving will help fund urgent recovery efforts and support key services like healthcare and education.

The government is now hoping to enact similar clauses with other creditors.

Can hurricane clauses become the norm for climate-vulnerable countries?

Grenada’s triggering of debt suspension clauses will be seen as a trial run to determine the effectiveness of the measure in bolstering national economies post natural disaster.

“Although no one wishes a hurricane on a country, it is good to see the natural disaster clauses that Grenada inserted into its bonds almost a decade ago doing exactly what they were designed to do,” Sebastian Espinosa, a debt expert at White Oak Advisory, who helped develop the clause for the country, told Reuters news agency.

Mike Sylvester, permanent secretary at Grenada’s Ministry of Finance, told Climate Home the suspension of debt repayments will create “some breathing space to the government to be able to properly and adequately respond to the crisis.”

Clauses to pause debt repayments after natural disasters could prove a lifeline for developing nations struggling against the effects of climate change amid rising debt.

Almost half of low-income countries are “at the intersection of high debt and climate vulnerabilities,” according to a March 2023 report by the UN Trade and Development agency (UNCTAD).

It warns of “a vicious cycle of perpetual vulnerabilities and economic stagnation” in countries on the frontlines of climate change that are experiencing financial distress.