Policymakers must act now to revitalise growth prospects, says the IMF.

The IMF's latest World Economic Outlook report has projected global growth at 3.2% in 2024 and 3.3% in 2025, in line with April predictions.

The group nonetheless noted that varied momentum in activity at the turn of the year has somewhat narrowed the output divergence, meaning differences in growth rates between economies are now smaller.

In terms of the disinflation process, the report noted that risks which drive prices higher have increased, "raising the prospect of higher-for-even-longer interest rates".

One such risk is escalating trade tensions, which can increase the cost of imported goods along the supply chain.

Petya Koeva Brooks, Deputy Director in the Research Department of the International Monetary Fund, discussed this trend further in an interview with Euronews.

"The other interesting phenomenon that we see is that there is growing evidence of fragmentation in trade. What we find is that the trade within politically close blocs has held up well and has compensated for the fact that trade between blocs has actually decreased."

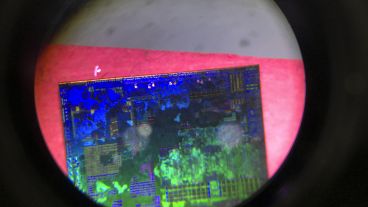

These warnings come despite the fact that trade proved robust at the start of the year, spurred by strong exports from Asia - particularly in the technology sector.

Asked about tariffs recently imposed on Chinese goods by the US and the EU, Koeva Brooks was critical.

"Such actions typically have a negative impact on the country that imposes them as well as on others ...some may very well be for good reasons, but we call on countries to resolve these grievances in a multilaterally compatible fashion rather than through these unilateral actions."

The European Commission has set provisional duties of up to 37.6% on EVs imported from China.

In May, the US announced a 100% tariff on Chinese-made electric vehicles.

Shoots of economic recovery

The IMF said shoots of economic recovery materialised in Europe and elsewhere, led by an improvement in services activity. This refers to non-tangible services rather than physical goods.

Koeva Brooks noted that this partially marks a natural shift in demand following the pandemic.

During lockdown periods, the consumption of goods shot up while services activity stagnated. Later, as social-distancing restrictions eased, the demand for services shot up again.

Consumption is equally driven by rising real wages, as well as higher investment from easing financial conditions, said the IMF.

Growth in the euro zone is expected to rise to 1.5% in 2025, with a modest pickup of 0.9% pencilled in for 2024.

The report highlighted that a "more sluggish" recovery is expected in Germany, which was hit hard by energy price shocks due to its reliance on fuel-intensive industry.

The country's year-on-year growth for 2025 is projected at 1.3%, while the estimation for 2024 sits at 0.2%. This follows a 0.2% contraction last year.

Global disinflation slowing

While growth recovers, this can cause inflationary bumps, warned the IMF.

As a result, policy makers may feel forced to delay interest rate cuts.

"The uptick in sequential inflation in the United States during the first quarter has delayed policy normalisation," said the IMF.

"This has put other advanced economies, such as the euro area and Canada, where underlying inflation is cooling more in line with expectations, ahead of the United States in the easing cycle. At the same time, a number of central banks in emerging market economies remain cautious in regard to cutting rates owing to external risks triggered by changes in interest rate differentials and associated depreciation of those economies' currencies against the dollar."

Commodity prices

The global outlook report also stated that IMF staff projections are based on upward revisions to commodity prices, including a rise in nonfuel prices by 5% in 2024.

Energy commodity prices are expected to fall by about 4.6% in 2024, less than previously projected in April. This deviation reflects elevated oil prices linked to reduced production by OPEC+ (the Organization of the Petroleum Exporting Countries, including Russia and other non-OPEC oil exporters). Also playing a role is price pressure caused by conflict in the Middle East.

Stronger activity in China

The IMF also revised the forecast for growth in emerging markets and developing economies upwards, powered by stronger activity in Asia, particularly China and India.

These two countries account for "about half the growth in the world economy," said Koeva Brooks.

China's forecast for 2024 sits at 5%, while India's year-on-year projected change is 7%.

When asked about disappointing Chinese GDP figures released earlier this week, Koeva Brooks noted that they could "pose a downside risk to our current forecast".

China’s economy grew 4.7% year on year in the second quarter, missing expectations.

"What's important for China is to tackle the issues in the property market," said Koeva Brooks, "and that is something that would bring confidence to consumers".

Policy recommendations

The report warns that in countries where upside risks to inflation have materialised, "central banks should refrain from easing too early" on interest rates.

Near-term challenges aside, countries must also seek to turbocharge lacklustre medium-term growth prospects.

One solution, said the IMF, is to level up labour output by better integrating women and immigrants into the workforce.

"While emigration of the young and educated population can take a toll on source countries, the costs can be mitigated. Policies that help leverage diaspora networks, maximise the benefits from remittances, and expand domestic labour market opportunities are possible avenues."

The group also highlighted the importance of multilateral cooperation to boost trade but also to tackle global issues, notably the climate crisis.